It seems a common occurrence for Financial Advisors to recommend moving savings dollars into more risk-bearing investments, because savings accounts “do not build wealth”.

They speak as if pulling out your savings dollars to make them work harder is destiny, as if that is the only option.

However, it is NOT the only option. Putting your savings into risky investments is NOT the only way to make savings dollars grow.

In fact, Albert Einstein, a mathematical genius, hinted at the alternative option when he said, “Compound Interest is the 8th Wonder of The World. He who understands it earns it. He who doesn’t pays it.”

Einstein was really on to something, but his hint is missing the one important word necessary to make his hint complete.

The word is “uninterrupted”.

“Uninterrupted Compound Interest is the 8th Wonder of The World.”

You see, the uninterrupted compounding of money over time grows wealth.

It grows significant wealth when informed people use it the way it works best.

Many voices that speak to us from the financial world encourage us to do the opposite.

FACT: Every time you interrupt your money’s compounding you STOP Your Money’s Power.

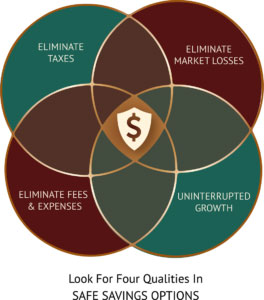

Imagine if you learned about the SAFE SAVINGS OPTIONS that are leveraged by smart money and used by wealthy families in which your money could stay safe from market losses, grow uninterrupted, and eliminate taxes, as well as fees & expenses.

It is certainly difficult for you to change what has already happened —

for example, the amount of taxes you were required to pay on your income as you reported it in a previous year.

However, you can begin doing things differently, and doing different things, the very moment that you now know what you did not previously know. And those different things will significantly improve your financial future and the financial legacy you will leave to your family and loved ones.

Often, people place their hard-earned Savings Dollars on a financial track that does not serve them well today, nor will it serve their future. We take the time to show you, as a committed saver, how to “Re-Steward Your Savings Future”.

Here, “Re-Steward” means you “Do Things Differently” in a way that’s in your best interest today and that serves you well into the future, by which time your savings dollars have been allowed to multiply — to grow and compound without interruption.

Some individuals learn to redirect some regular financial expenditures.

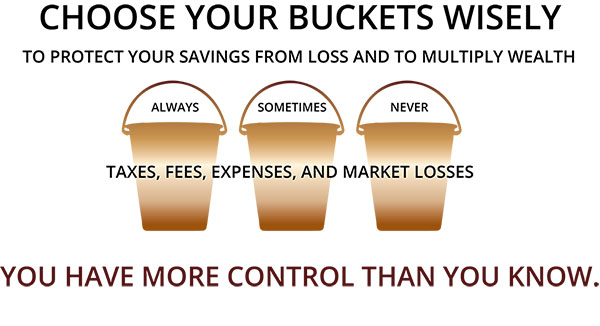

Others learn “you have more control than you know” and they stop putting their savings in buckets always subject to taxes, fees, expenses and market losses.

Many individuals learn to tap the power the U.S. Tax Law gives you to grow and protect wealth.

You might choose to follow the Wealthy Family Model as soon as you see it.

Every month when it’s time to make the payments, your money “goes away,” and with it you lose the use of that money for anything else. Some people have learned to use that same money to make payments that enable the use of that money, because of collateral capacity. This means what was an expense liability now acts as an asset. It is important to you and your family that you learn what this can mean for you.

We agree it is good to learn how U.S. Tax Law is written specifically to allow us taxpayers to avoid paying tax. And as we learn more, we avoid even more tax. But there’s even more beyond that. The U.S. Tax Law gives a clear path to take those dollars we just shielded from taxes and leverage those dollars as an asset to benefit our businesses. For example, to enable the purchase of a building.

You turn, “I can’t afford this,” into , “It’s clear now how I can afford it.”

Experts agree that uninterrupted time on a project yields superior productive results. Interruptions take us off track and out-of-focus. When we stay focused and on track we can make a project more successful sooner. When it comes to the money we save, it is remarkable how much more productive that money becomes when it stays on track. Interruptions kill money’s capacity for compounding—interruptions like spending the money for any reason, or paying fees or even paying taxes. It is important to you and your family for you to learn how to harness the power of not interrupting money on its way to growing legacy wealth.

It will empower you to learn how to put in place a lifelong strategy that provides a financial legacy free of many traditional encumbrances like trustee fees, probate costs, and taxation.

That strategy includes using vehicles that meet the Four Qualities of SAFE SAVINGS OPTIONS.

That strategy includes putting things in place that stay in place uninterrupted, growing consistently without risk, without taxes.

That strategy includes the use of “bucket #3,” and it includes having collateral use of your wealth.

There is a huge opportunity for individuals who are committed savers in the choices they make concerning taxation.

Many people hear from advisors that it is good to defer taxes—to use government-approved accounts which postpone taxes on income until withdrawal—then you pay taxes every year throughout your post-retirement years, which can extend for decades.

It is important to you and your family that you learn the real numbers of the opportunity to never have to pay taxes in the future, because you chose to not defer the taxes.